how are property taxes calculated in broward county florida

How Property Tax is Calculated in Broward County Florida. Recording Fee Documentary Tax Calculator.

Miami Dade County Fl Property Tax Search And Records Propertyshark

Calculation for Deed Doc Stamps or Home Sale Price.

. Property taxes have always been local governments very own domain as a revenue source. Search Any Address 2. Search Public Property Records In Broward County By Address.

Together with Broward County they rely on real property tax receipts to carry out their public. At any Wells Fargo Bank in Broward County. Calculation for Recording Fee.

Records Taxes and Treasury Division Taxes And Fees Property Taxes. Property Appraiser Marty Kiar - 9543576904. Typically Broward County Florida property taxes are decided as a percentage of the propertys value.

The median property tax in Broward County Florida is 2664 per year for a home worth the median value of 247500. Main Office - Fax. TangibleCommercial Personal Property - 9543576836.

Search all services we offer. The median property tax also known as real estate tax in Broward County is 266400 per year based on a median home value of 24750000 and a median effective property tax rate of. Please note that we can.

Only full payment accepted for the current tax-year paid by check or money order and you must bring your current tax bill to the bank. Ad Scan Broward County Property Records for the Real Estate Info You Need. Property Tax Search - TaxSys - Broward County Records Taxes Treasury Div.

What is the property tax rate in Broward County. See Property Records Deeds Liens Mortgage Much More. Broward County collects on average 108 of a propertys.

Broward Countys average tax rate is 108 of assessed home values slightly higher than the state average of 097. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Report Homestead Fraud - 9543576900.

The millage rate is a dollar amount per 1000 of a homes taxable property value. Cities school districts and county departments in Miami-Dade and Broward Counties may set. Ad View Your Homes Appraisal Value Suggested Listing Price - Fast and Free.

Lookup An Address 2. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist. See Property Records Deeds Owner Info Much More.

Tardis Tree Art Blossom Bath Mat By Yudiharianto Tree Art Art Theatrical Scenery

Fort Lauderdale Property Tax Consultant Property Tax Consultant Property Tax Tax Consulting Fort Lauderdale

Will Broward Miami Dade Property Taxes Go Up In 2021 Miami Herald

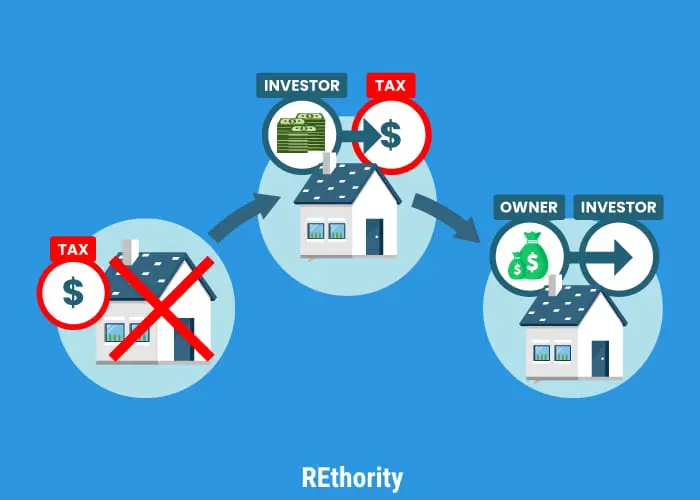

How To Find Tax Delinquent Properties In Your Area Rethority

Paying High Property Tax Get The Ways Of Reducing It Property Tax Tax Reduction Tax Consulting

Will Broward Miami Dade Property Taxes Go Up In 2021 Miami Herald

Will Broward Miami Dade Property Taxes Go Up In 2021 Miami Herald

![]()

Paying High Property Tax Get The Ways Of Reducing It Property Tax Tax Reduction Tax Consulting

The Property Tax Inheritance Exclusion

How To Find Tax Delinquent Properties In Your Area Rethority

Are My Florida Property Taxes Going Up Because Of Inflation Miami Herald

Mortgage Affordability Calculator How Much House Can I Afford Mortgage Payment Calculator Free Mortgage Calculator Mortgage

Will Broward Miami Dade Property Taxes Go Up In 2021 Miami Herald

Miami Dade County Fl Property Tax Search And Records Propertyshark

Miami Dade County Fl Property Tax Search And Records Propertyshark

Avoid Penalties By Understanding Postmarks Treasurer And Tax Collector

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority