will salt deduction be eliminated

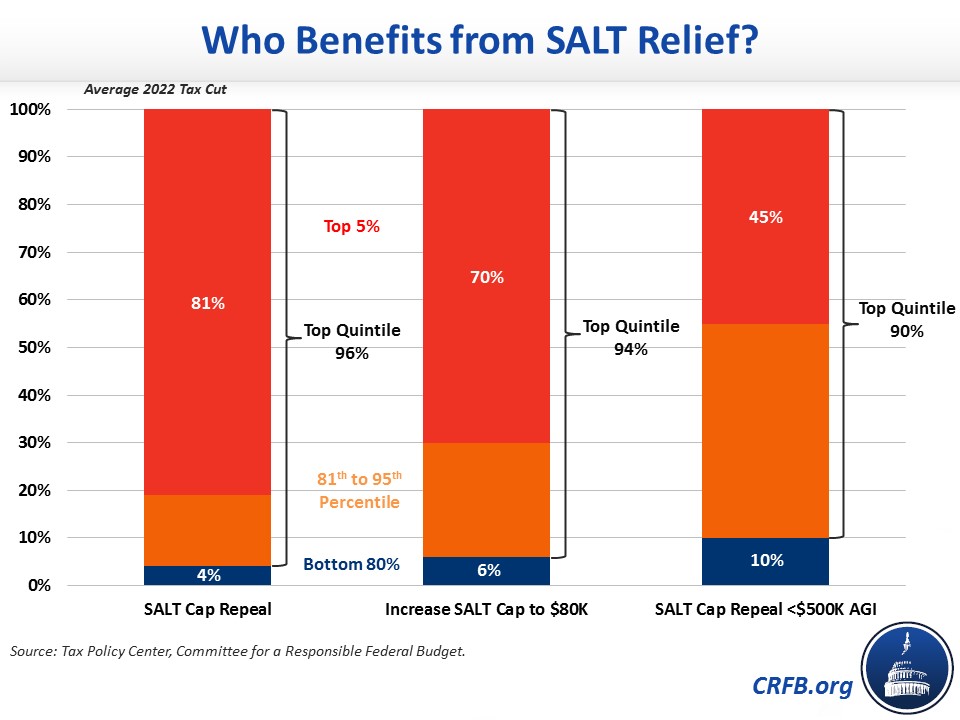

A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and local tax deductions known as SALT. The SALT tax deduction is a handout to the rich.

Dems Demanding Salt Tax Cuts Stand To Benefit

Yes eliminating the SALT deduction will be a tax primarily on the wealthy minority sorely needed to pay for programs to rebuild the country.

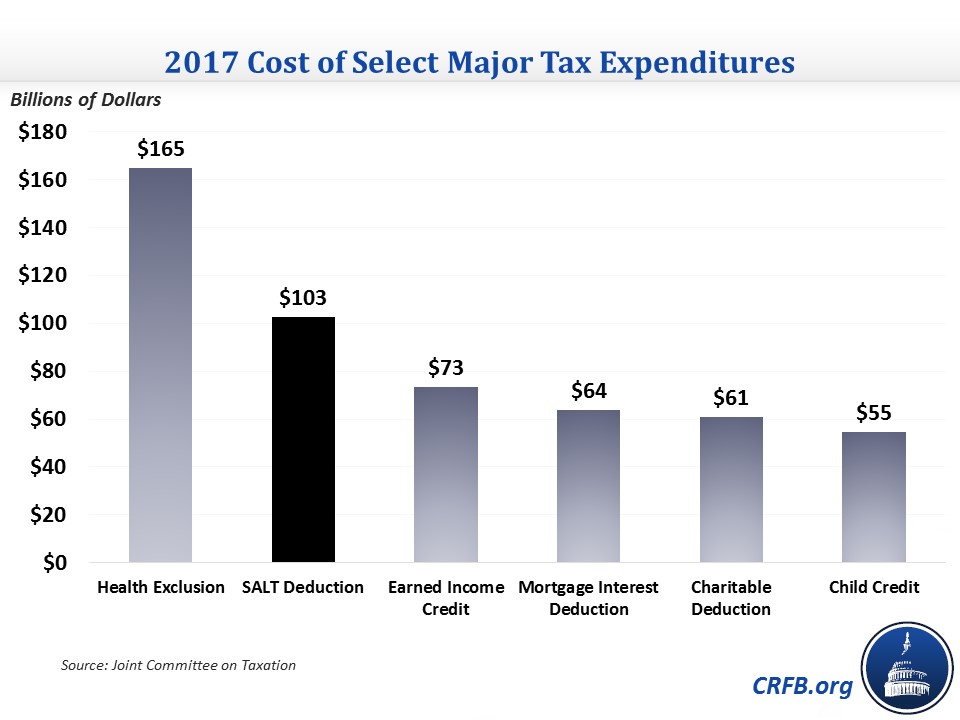

. A recent July 2021 estimate by the Tax Foundation put the loss to the Federal government at 380 billion. Nita Lowey D-NY and Rep. The delegations promoting the reinstitution of SALT.

The SALT tax deduction is a handout to the rich. However its been a controversial. The SALT deduction should be eliminated altogether along with the wide range of energy tax credits housing credits and place-based credits such as opportunity zones.

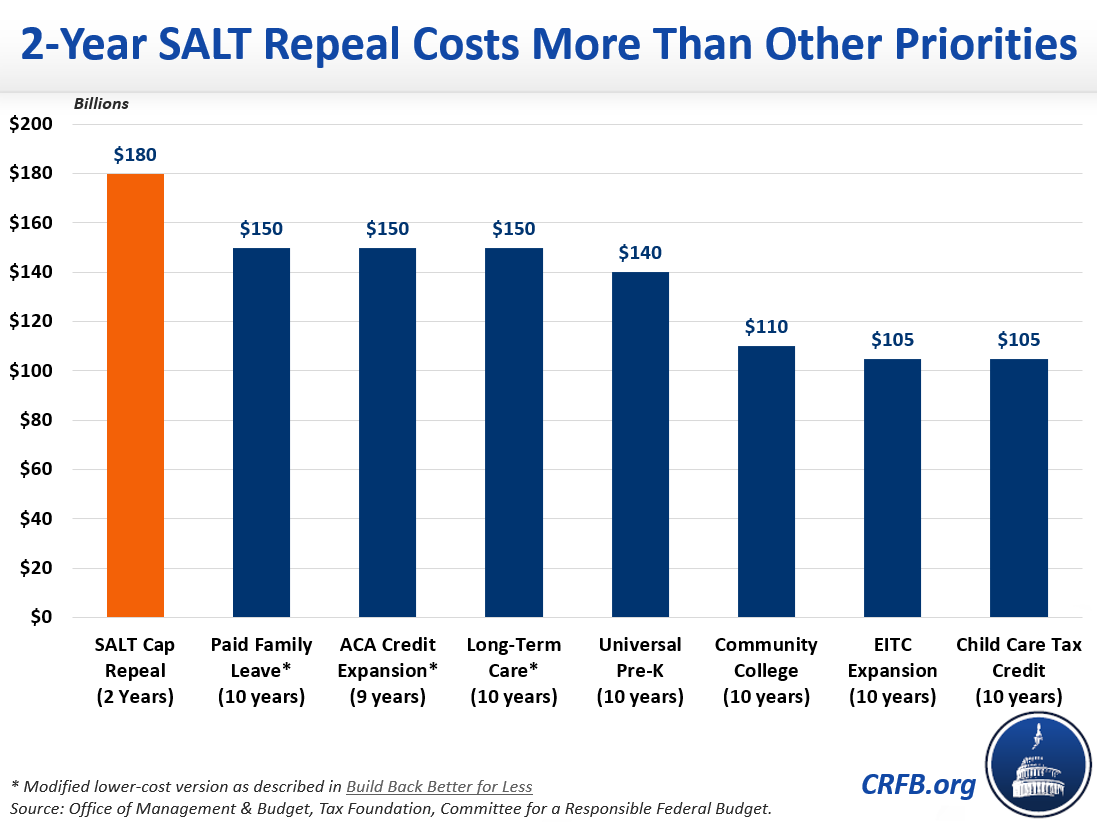

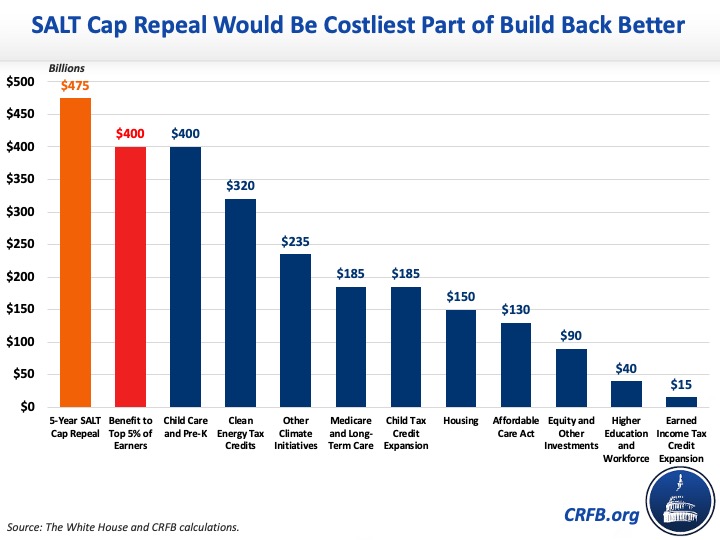

According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better reconciliation package including one. CBO projected in 2019 that the elimination of the SALT cap for the calendar year 2021 would be 887 billion. It should be eliminated not expanded.

The deduction for state and local taxes has been around since 1913 when the US. The federal tax reform law passed on Dec. The state and local tax SALT deduction cap will be eliminated for five years as part of the Build Back Better social spending package according to multiple reports.

Indeed under the Big 6 tax framework released last month repealing the SALT deduction would raise 13 trillion enough to cover the costs of reducing individual tax rates to 12 25 and 35 percent or pay for doubling the standard deduction and expanding the child tax credit. To address this the bill would eliminate the SALT deduction cap for single or joint filers that make under 400k. Reeves Friday September 4 2020 The politics of.

Double taxation doesnt make sense. Eliminating the SALT Deduction Cap Would Reduce Federal Revenue and Make the Tax Code Less Progressive January 4 2019 Kyle Pomerleau Rep. First instituted our federal income tax.

The topic goes beyond simple politics. Here come tax cuts for New Jersey families. It should be eliminated not expanded Christopher Pulliam and Richard V.

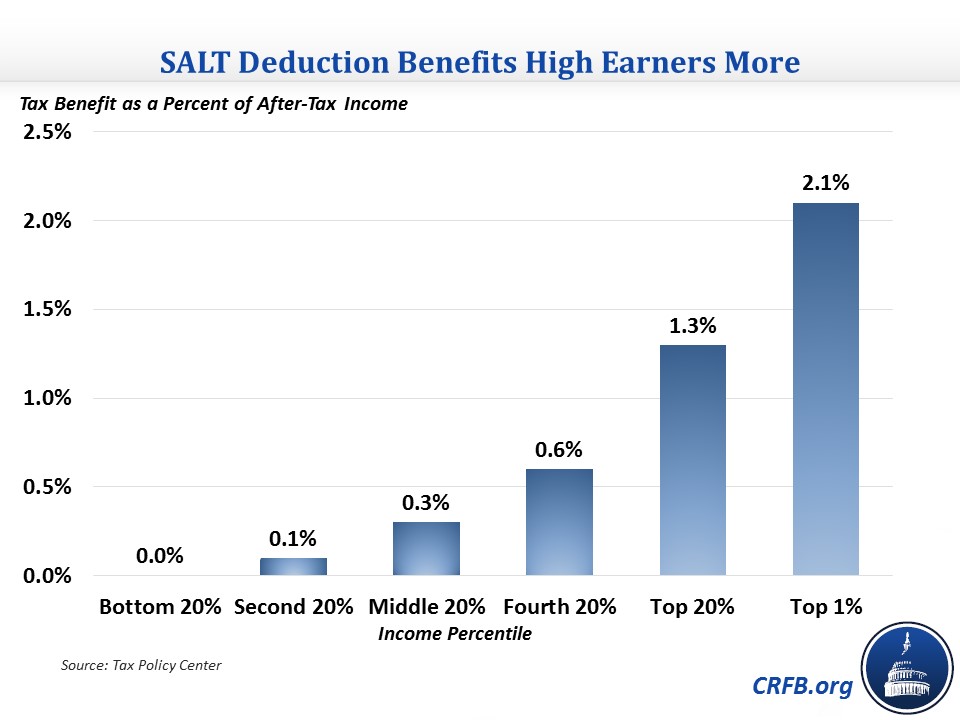

S social spending and climate package. It is important to understand who benefits from the SALT deduction as it currently exists and who would benefit from the deduction if the cap were repealed. Nothing wrong with making the tax code more progressive.

Other high tax states like California and New Jersey will feel the same pressure to reduce taxes from their state and local taxpayers. Reinstating the State and Local Tax SALT deduction will be in the final legislative package. Yes actually there shouldnt be a single tax deduction for anything.

Democrats from blue states such as New York and New Jersey have been pushing to include a rollback of the SALT deduction. Peter King R-NY introduced a bill in the House of Representatives to repeal the 10000 cap on the state and local deduction SALT. Many economists believe that a complete repeal of the cap on the SALT deduction would be costly to the federal government.

The TCJA eliminated or reduced the following deductions some of which could be reinstated when the legislation expires in 2025. Mondaire Jones the bill would allow New Yorkers to fully deduct their state and local taxes. Defenders of the SALT deduction such as the National Governors Association point out that state and local income real estate and sales taxes are mandatory.

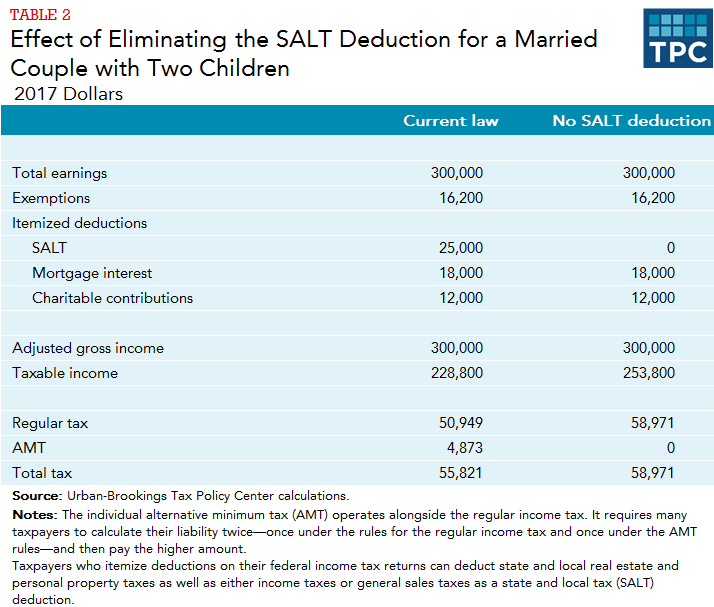

This is the second-largest revenue-raiser in the proposed reform. Taxpayers cant get out of them. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly.

This commonly referred to estimate was made before workaround legislation was passed. Nov 2 2021. 54 rows Some lawmakers have expressed interest in repealing the SALT cap which was originally imposed as part of the Tax Cuts and Jobs Act TCJA in late 2017.

Why the SALT Deduction Matters. The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to 10000. For filers making 400000 and above the SALT deduction cap would start at 60000.

Bill To Eliminate SALT Deduction Cap Introduced In Congress - Yorktown-Somers NY - Introduced by Rep. Good luck getting that past the lobbyists 2 level 2 LongConvexity1 1y The SALT and MID are both particularly regressive deductions which is why we should focus on them. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before dropping it back to 10000 in 2031.

If the SALT deduction were to be eliminated people living in high tax states like California and Connecticut would be pressured to take. New York Governor Andrew Cuomo said that if the SALT deduction is eliminated New York State will be destroyed because of that pressure on the state and local governments to reduce or eliminate some taxes. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

The TCJA capped SALT deductions at 10000. SALT change on ice in the Senate.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

No Eliminating The Salt Cap Will Not Reduce Charitable Giving

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Opinion The Debate Over A Tax Deduction The New York Times

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

How Does The Deduction For State And Local Taxes Work Tax Policy Center